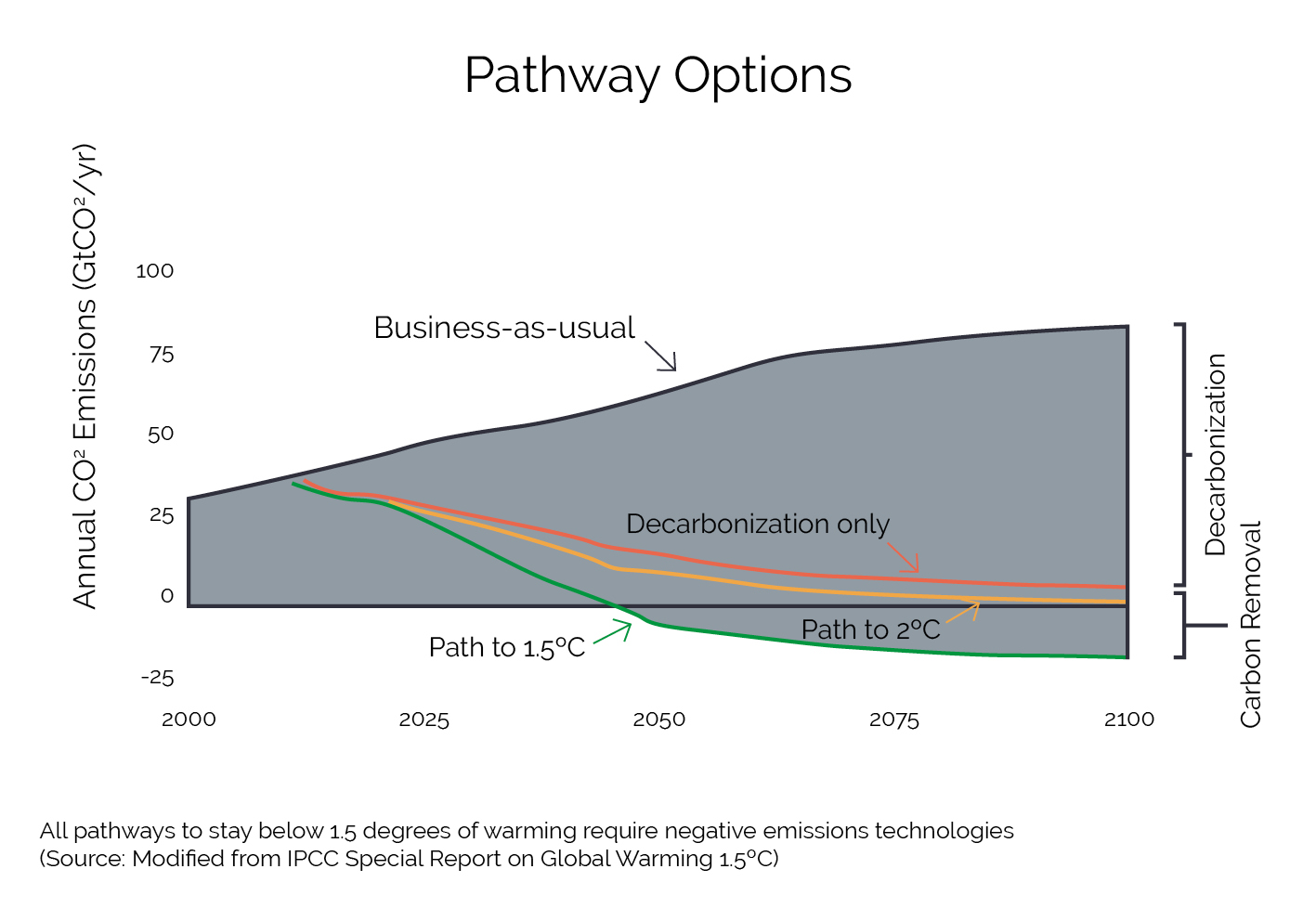

The IPCC report shows that emission reductions will not be enough to achieve the global climate goal of limiting global warming to below 1.5 °C. Negative emissions, or removing historical emissions from the atmosphere, will be necessary. The target of Net Zero is to reach a point where the amount of greenhouse gases emitted into the atmosphere is balanced with an equivalent amount removed.

Experts predict that over the next 30 years, methods of removing carbon from the atmosphere will become the main means of achieving and maintaining zero emissions. (Graph source: AirMiners)

Carbon credits are one of the main tools to direct capital to projects that reduce or directly remove emissions from the atmosphere. Carbon credits are a way to link economic growth with biodiversity restoration. However, carbon credits are not appropriate as the only approach to reducing carbon footprints. They are only one element of a broader, more comprehensive strategy to reduce emissions (decarbonization).

Companies decide on an ESG strategy and set targets to achieve their goals. One such goal many companies chose to set is to achieve carbon neutrality or Net Zero by a certain year. According to the IPCC, the latest that Net Zero should be reached is 2050, but earlier action is more effective and helps improve the chances of limiting global climate warming.

Any company wishing to achieve carbon neutrality or Net Zero will need to count on using carbon credits to offset its final carbon footprint.

The first step companies need to take is to calculate their carbon footprint so that they know where they stand. This data then shows where the company should focus its emissions reduction efforts.

Next, the company works to reduce its direct carbon footprint (typically in Scope 1 and 2) until it exhausts all available options. Scope 3 emissions apply to the supply chain, where it is more difficult to not only collect data but also to have an impact on the amount of emissions generated. Often, reducing emissions in Scope 3 is a longer haul because it requires the input of all suppliers.

At this stage, companies often conclude that they cannot eliminate further emissions for many reasons. In this case, they can offset them by purchasing carbon credits, ideally with added social and environmental benefits. Carbon credits are therefore a complement, not an alternative, to other reduction measures

1 carbon credit (or offset) is equivalent to 1 tonne of CO2eq*. In the case of regenerative agriculture, 1 tonne of CO2 from the atmosphere is sequestered into the soil. These credits are sold on the Voluntary Carbon Market (VCM). They are not emission allowances that are traded on regulated markets, like the EU ETS.

*"Equivalent" is used because there are other greenhouse gases (ex. CH4, N20) but they are all converted to CO2 equivalents for simplicity according to coefficients established by the scientific community.

Carbon credits are certificates that are issued when carbon dioxide is removed from the atmosphere or prevented from entering the atmosphere in the first place. There are 2 main types of carbon credits, namely engineered and nature-based solutions. The idea behind Nature-Based Solutions is to enhance natural ecosystems, such as forests and agricultural land, which can absorb more carbon dioxide, thanks to photosynthesis, than they release.

Carbon removal is just one type of carbon credit. There are also avoidance and reduction credits that reduce the amount of new emissions that enter the atmosphere but do not remove historical emissions directly. Most companies that buy carbon credits buy avoidance and reduction credits, which include renewable energy projects or forest conservation. These carbon credits, which account for around 90% of the credits on the market, are cheaper but have less of a climate impact.

Much emphasis is placed on the difference between removing CO2 from the atmosphere and avoiding CO2 emissions. This is one of the reasons why it is not currently recommended to buy REDD+ or renewable energy credits to offset the carbon footprint.

While there have been cases of problematic nature-based carbon offsets, there are many legitimate projects that reduce and mitigate emissions, with accompanying social and environmental benefits.

The global acceleration of the transition to Net Zero is under scrutiny. Some critics claim that carbon offsets are a scam. According to CarbonCredits, there are several key points to consider in this debate.

In 2023, several studies (such as this and this) were published comparing more than 7,000 companies. The studies found that firms that buy carbon credits are more effective at reducing their carbon footprint than those that do not. Specifically, they are 1.8x more likely to be decarbonizing year-over-year, 3x more likely to include Scope 3 emissions in their targets, and 3.4x more likely to have approved science-based climate targets.

In part 2 of this blog (to be published in mid-February 2024), we will focus on assessing the quality of carbon credits and the specifics of carbon credits from regenerative agriculture. I will also answer some questions related to the role of carbon credits as part of a company’s decarbonization strategy.

Read more about carbon credits on our blog.

Check out our Company Report.